IOHK’S STAKING CALCULATOR

IOHK published a staking calculator, which lets you enter a number of variables to obtain an estimate of expected pool rewards. Although IOHK explicitly are mentioning the results should be interpreted with caution, it should give you an idea how various variables influence potential results.

SIMULATING EXPECTED REWARDS OF 4ADA

–last update: May 31, 2021–

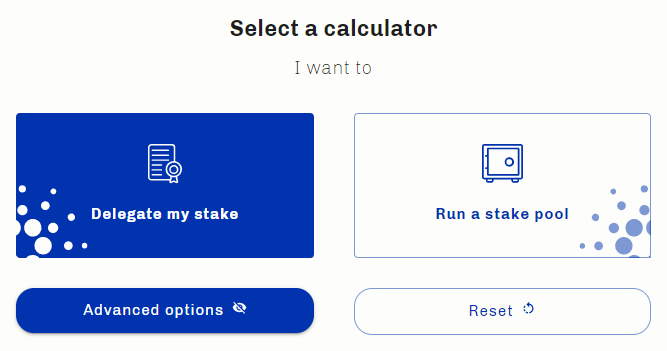

Let’s have a look at some of the variables and how you can modify them to simulate our 4ADA pool. Make sure “DELEGATE MY STAKE” is selected, and choose “ADVANCED OPTIONS”.

ADA AMOUNT

1000 ADA

This is the amount you are staking with. You can choose any amount, but make sure not to change it when comparing between pools.

STAKE POOL DAILY FIXED FEE

68 ADA

68 per day is equivalent of 5*68=340ADA per epoch. This is the minimum fixed fee imposed by the protocol. Pools can set this higher, but not lower. The amount is deducted from total pool rewards every epoch, before calculating the rewards for all delegators.

Just to clarify: 340ADA are NOT deducted from your personal rewards. And, you do NOT have to pay 340ADA to a pool when delegating.

IMPORTANT: most pools leave the 340ADA fixed fee per epoch at its minimum, but pay attention, as there are some pools which charge more than that, which has a substantial impact on rewards, especially if the pool is small!

AVERAGE TRANSACTION FEES PER EPOCH

0 ADA

Whenever a pool produces a block, it not only receives a block reward, but also all the transaction fees for all transactions contained in that block. In the long run this is expected to become an important factor, but for the time being let’s leave it at zero.

STAKE POOL OPERATOR’S STAKE

300,000 ADA

This amount is better known as PLEDGE. It is the amount of ADA permanently delegated by the pool owner, and is indicative of the pool owner’s own ‘skin-in-the-game’.

The significance of pledge is merely symbolic. It demonstrates a pool owner’s confidence in its performance, but whether a pool has low or very high pledge has very little influence on its rewards.

STAKE POOL TOTAL STAKE

40,000,000 ADA

A bigger pool size helps absorb the 340ADA fixed fee, and weighs more heavily on very small pools (<5M ADA), forcing them to operate at 0~1% variable fee in order to stay competitive.

Once a pool approaches its saturation level (62M ADA), its rewards can get capped every now and then, resulting in less than optimal rewards for its delegators. On the other hand, very small pools sometimes may not produce any rewards during an epoch. For this reason it is wiser to delegate to mid-sized pools, ranging between approx. 2M~50M, especially if you do not monitor their growth on a regular basis.

TOTAL STAKE POOLS

500

Also referred to as “k-factor”, this fixed protocol parameter determines how large a pool can get before its rewards saturate. It implies that over time it is expected that there would be 500 perfectly filled pools producing optimum rewards. In reality, pools will never be perfectly filled, leaving room for more than 500 smaller pools to co-exist.

STAKE POOL OPERATOR REWARD PERCENTAGE

2%

This variable pool fee, set by the pool operator, is automatically deducted each epoch from delegator rewards, and serves as compensation for the staking service rendered. Pool operators use this fee (and the fixed fee) to cover their expenses and keep their pools -and the Cardano network- healthy.

Contrarily to what most delegators think, the impact of variable fee on rewards received is not very high at all. For example, for a delegation of 1000 ADA, the difference in rewards after one year, between 4ADA (2%) and a 1% pool, is only 0.53 ADA, or 0.05%! Don’t believe it? Check for yourself by changing the variable fee in the calculator, leaving everything else unchanged.

STAKE POOL PERFORMANCE

100%

This represents the percentage of blocks missed by a stake pool. For consistency between pool comparisons, simply leave this at default (100%).

INFLUENCE FACTOR (a0)

0.3

Better known as the “Pledge Factor”, this fixed parameter determines the impact of the pool’s pledged amount on the rewards for all delegators. Currently, at 0.3, the impact of pledge is almost non-existent, giving a pool’s pledge amount above all subjective meaning, indicating to what extent the pool operator is able and willing to link their own delegation results with yours.

TREASURY RATE

20%

The percentage of total rewards per epoch paid out to the Cardano Treasury, before distributing all remaining rewards to all delegators and pool operator’s. Leave at default (20%).

EXPANSION RATE

0.3%

This represents the inflation-rate of the protocol, and determines how many ADA are added to the total supply every epoch. Leave at default (0.3%).

4ADA RESULTS

Given [4ADA]’s current size of 37M ADA, the expected ROS (Return On Stake) is 5.15%, resulting in the following gains after one year:

- For 1000 ADA delegated: 51.51 ADA

- For 10,000 ADA delegated: 515.10 ADA

Comparing this to a 1% pool of 50M (5.22% ROS):

- For 1000 ADA delegated: 52.21 ADA

- For 10,000 ADA delegated: 522.05 ADA

Or to a saturated 2% pool of 64M (4.95% ROS):

- For 1000 ADA delegated: 49.48 ADA

- For 10,000 ADA delegated: 494.83 ADA

So, as you can see the rewards differences between pools are very small, as long as the pools are not missing blocks and as long as they are not saturated!

This knowledge should give you the freedom to perhaps choose your pool not so much based on expected rewards, but rather on other influencing factors, such as sustainability, donations to charity, decentralized vs. hosted in the Cloud etc. etc.

But why not start doing a bit of research on your own? Do let us know the results of your findings by posting a comment below!

Happy staking! 🌞

Jos

Very informative, Thank You and keep the updates coming 🙂

Glad you find it useful. And about the updates, let me use Charles’ words from just minutes ago; this is just the beginning!

Lekker bezig Jos! Zojuist besloten om een gedeelte van mijn ADA te verplaatsen naar een andere wallet om ook te delegeren naar een van je pools!

Leuk om te horen man! Laat af en toe horen wat je er van vind allemaal.

duidelijk verhaal en mooi dat je deze extra info geeft! Ik ben blij als het inderdaad rond de 5% uitkomt

Kleine moeite en ik vind het belangrijk dat zoveel mogelijk delegators zien dat verschillen in pool rewards tussen ogenschijnlijk goedkope, iets minder goedkope en/of succesvolle pools, in de praktijk meestal ver achter de komma gezocht moet worden.

Great article. I have debuted my ADA’s for the 4ADA pool since the testnet and have had excellent results. About the rewards on the mainnet, so far I have not received any rewards, this is normal, is happening to the other delegates? I delegated it to 4ADA. Congratulations on your work.

So, do I get this right?

1.

If I started a new pool I would have to pay 68ADA per day?

2.

I need to invest at least 100kADA first?

3.

I assume there is no guarantee that people will use my pool, right?

Hi Klaus,

1. no what i meant to say is that you cannot register a pool trying to use a value for fixed fee lower than 340ADA/epoch. So, a pool will always earn 340 per epoch as long as at least one block has been minted. The amount will however weigh heavily on delegator rewards if the pool is very small, which makes very small pools somewhat less attractive.

2. no, 100k was taken by example as a basis to calculate delegation rewards. Use any amount you like, but always use the same amount if you want to compare between different pools.

3. no there is no guarantee whatsoever; delegators are free to choose any pool they like, so attracting one or two large delegators is almost imperative to start showing decent performance which is needed to attract more delegators.

That´s weird!

The Rewards Calculator does always show the same amount for “Stake Pool Operation Rewards” and “Running Costs” wether I put 1000ADA or 1Mio ADA in the input field.

Is this correct?

So, I can setup a node and get 52k ADA by investing 1k ADA?

The minimum running costs are the minimum expenses IOHK estimates stakepool operators are making to run their pool, based on which they implemented the 340ADA/epoch minimum cost (340 * 73 epochs/yr = 24820ADA). If you change the 68/day to a higher number, you will see that the presumed running costs increase. The Stake Pool Operation Rewards are based on the default setting of the calculator at 64M total delegated stake minus the running costs. If you reduce the total delegated amount or increase the running cost, you will see operation rewards will change as well.

sorry, that does not help. If I start a pool just to get going with say 1000ADA. When I connect this to the network. What will happen? I understand that I might get no riddle to solve because 1000ADA makes it most unlikely to get choosen, right? But, will I have to pay 68ADA per day or will the server just sit there, do nothing and that´s it? When I then find investors or people to choose my pool and funds increase to say 100k. What will happen then?

Your only cost to set up and run a stakepool are:

1. pool registration + some tx cost; total 510ADA (when de-registering the pool you will get the 500ADA back)

2. pool running cost; hardware, (web-)hosting, power and laboour cost depending on your situation

Thanks, I understand (2).

As for (1):

why is the daily cost of 68 a parameter I can choose? My actual hardware/hosting costs will be not more than 10$ a month.

Maybe I am thinking too complicated after all.

I understand the 68 parameter is confusing. Before mainnet went live, IOHK decided there should be an imposed minimum fixed pool fee of 340/epoch -or 68/day- to avoid a race to the bottom with many unserious 0% pools, potentially threatening the professionality and stability of the network.